Nobody has but outlined what 6G truly is, not to mention the way it will succeed economically

Editor’s notice: That is the primary installment of a three-part sequence from Analyst Vish Nandlall. Preserve an eye fixed out for components two and three, coming quickly.

Each cellular era has been greater than only a technical improve. It has been an financial story about how worth is created, delivered, and captured. 3G, 4G, and 5G every got here to market with a well-formed enterprise mannequin and a transparent foundation of competitors. They grew within the context of increasing gadget penetration and unmet demand, giving operators room to seize new worth. However because the business now friends towards 6G, one reality is obtrusive: Nobody has but outlined what 6G truly is, not to mention the way it will succeed economically. The desk isn’t set for achievement.

| Characteristic | 3G (The Catalyst) | 4G (The Revolution) | 5G (The Bifurcation) | 6G (The Dilemma) |

| Period | Cell Telephony | Cell Compute | Cell and Edge Compute | ? |

| Major Worth Created | The potential for the cellular web. | The mobile-first app financial system. | Aggressive broadband different (FWA) & city capability aid. | Unclear. A “community of cognition” for speculative use circumstances. |

| Foundation of Competitors | Protection & Primary Reliability. | Pace & Community Efficiency. | Mid-Band Spectrum Depth. | Unclear. Excessive efficiency metrics with diminishing marginal worth. |

| Key Demand Driver | Preliminary adoption of cellular/wi-fi units. | Explosion of smartphone penetration and app utilization. | Demand for dwelling broadband competitors; city knowledge congestion. | None demonstrated. Assumes future demand for AR/VR and sensing. |

| MNO Income Progress (CAGR, Peak Rollout) | N/A (Pre-IPO/Early Knowledge) | ~4.3% (Verizon, 2010-2015) | ~0.6% (Verizon, 2019-2024) | Speculative. |

| MNO ROIC vs. WACC | N/A | > WACC (Worth Accretive) | ~ WACC (Worth Impartial/Harmful for some) | << WACC (Extremely Worth Harmful beneath present value projections) |

3G: The cellular web

3G emerged within the aftermath of the dot-com and telecoms crash, when capital was scarce and skepticism was excessive. Its worth proposition was easy however highly effective: cellular entry to the web. Electronic mail and fundamental net searching went from tethered desktops to handsets. Operators monetized this shift by means of tiered knowledge plans, and the idea of competitors was protection and reliability. It was not glamorous, but it surely created a sturdy new income stream that carried the business by means of a interval of monetary retrenchment.

Macroeconomic context mattered. International cellular penetration was nonetheless in its development section, with huge populations but to be related. Buyers, although cautious, noticed upside in subscriber development. Common income per consumer (ARPU) was modest however rising steadily as customers shifted from voice and SMS to knowledge bundles. Capital depth was excessive, however the incremental income justified the spend.

4G: Cell apps and video

If 3G made cellular web attainable, 4G made it indispensable. Launched in a market already primed by the iPhone and the App Retailer, 4G was the proper enabler of the mobile-first digital financial system. Video streaming, social networking, and ride-sharing turned mass-market realities. For operators, this was the golden age: customers willingly paid for extra knowledge, limitless plans proliferated, and community pace turned the brand new aggressive benchmark. The worth was clear, the client want was confirmed, and operators captured significant development.

The macro context was equally favorable. Smartphone penetration skyrocketed from beneath 20% in 2007 to greater than 60% by the mid-2010s. Knowledge consumption per consumer grew at double-digit annual charges. ARPU held agency, even rising in lots of markets as customers upgraded to bigger knowledge packages. Capital expenditures have been vital (eg spectrum auctions and LTE rollouts consumed billions) however operators loved income development that exceeded value of capital. Within the U.S., Verizon’s revenues rose from $106.6 billion in 2010 to $131.6 billion by 2015, a compound annual development charge of 4.3%. Buyers rewarded the sector, and for as soon as, telcos captured a significant share of ecosystem worth.

5G: eMBB, edge, and FWA

5G promised to repeat the 4G playbook: quicker speeds and revolutionary new use circumstances. Enhanced Cell Broadband (eMBB) was meant to carry shopper experiences, whereas edge computing and ultra-reliable low-latency communications have been touted as enablers for the enterprise. In follow, nonetheless, 5G turned a narrative of incremental positive factors. For customers, the distinction was quicker downloads, this proved helpful, however not transformative. The enterprise revolution by no means materialized at scale. As an alternative, Mounted Wi-fi Entry (FWA) emerged because the lone breakout, lastly giving telcos a reputable technique to problem cable broadband. In any other case, 5G has largely been a churn-management instrument, a technique to preserve clients from defecting quite than a brand new development engine.

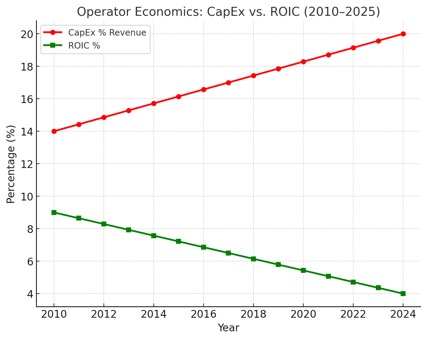

Right here the macro context was far much less forgiving. By the point 5G launched, cellular penetration in superior markets had reached saturation (over 100% SIM penetration in lots of international locations). ARPU had been in regular decline for years as competitors intensified and regulators pushed down roaming and termination charges. Capital depth soared, with world operators spending greater than $600 billion on 5G networks by 2023. But income development barely budged. Verizon’s CAGR from 2019 to 2024 was solely 0.6%. Returns on invested capital struggled to exceed weighted common value of capital, elevating severe doubts about whether or not the era created or destroyed shareholder worth.

The query of 6G: What’s it?

This brings us to 6G. Each previous era had a transparent reply: 3G was the cellular web, 4G was cellular apps and video, 5G was eMBB and FWA. However what’s 6G? No consensus exists. Futuristic visions just like the “Web of Senses” or holographic communications seize creativeness however crumble beneath financial scrutiny. With no clear worth proposition, 6G dangers changing into the primary era launched with no outlined enterprise mannequin.

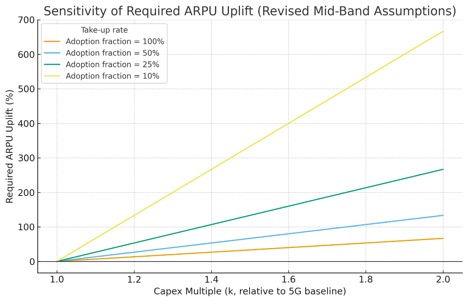

The economics are daunting. Mid-band 6G, probably the most life like path, calls for 20–100% increased capex than 5G. That would work if adoption is broad, requiring solely a ten–30% uplift in ARPU. But when 6G is area of interest (say, solely 10–25% of customers use premium AR/VR) ARPU would want to rise by 100–275%, ranges the market has by no means tolerated. In brief, the numbers don’t add up.

In the meantime, the macro context is even harsher than for 5G. Penetration is already saturated, leaving little room for subscriber-driven development. ARPU continues to face downward stress from aggressive bundling, OTT substitution, and regulatory intervention. Capital markets are more and more skeptical of telcos’ means to generate returns, punishing operators whose ROIC lags value of capital. With capital depth projected to climb once more, operators face the prospect of upper spending with no clear path to monetization.

The strategic crossroads

The business can not assume that efficiency enhancements alone will generate demand. As soon as a community is “ok” for 4K video and cellular apps, incremental positive factors in pace or latency not transfer markets. With no new foundation of competitors, operators are left holding the invoice for infrastructure whereas hyperscalers and gadget makers seize the application-layer worth.

That is the value-capture disaster on the coronary heart of 6G. The know-how roadmap is wealthy with potentialities, however the enterprise logic stays absent. Until the business defines what 6G is (not technically, however economically) it is going to danger changing into a $600 billion train in constructing the world’s quickest bit pipe.

The stakes

The development from 3G to 5G teaches us that know-how alone doesn’t assure success. 3G, 4G, and 5G every are aligned with a transparent financial context, increasing penetration, and an identifiable foundation of competitors. 6G, in contrast, stands at a crossroads with no outlined mannequin. The desk isn’t set. Until operators and requirements our bodies anchor 6G to confirmed demand drivers and sustainable enterprise fashions, it could go down in historical past not as a revolution, however as a cautionary story.