The current wave of maximum climate—from “atmospheric rivers” drenching the drought-ridden west coast, to the unprecedented collection of tornadoes ripping by means of the Midwest—are an ideal parallel to what traders skilled in March. Although “turbulent” has been an ideal descriptor for the dramatic turns available in the market ever for the reason that Fed first started boosting rates of interest a 12 months in the past, issues got here to a bona fide boiling level final month, pushed largely by the three financial institution closures that induced world panic, vital deposit outflows, and a short however sharp downturn as a seeming disaster of confidence gripped world markets. And but, regardless of the March Insanity, the primary quarter formed as much as be a winner. The ROBO World Indexes had been no exception, with features posted throughout the board. The ROBO World Synthetic Intelligence Index (THNQ) jumped +22.8%, the ROBO World Robotics & Automation Index (ROBO) returned +17.71%, and the ROBO World Healthcare Know-how & Innovation Index (HTEC) gained +3.33%.

That resilience begs the query: is it potential for the final decade’s playbook of progress to final perpetually? Whereas the occasions of the final two weeks definitely uncovered some idiosyncratic points, in our opinion it’s troublesome to argue that the system itself faces any kind of existential menace past tighter general monetary circumstances (which, albeit, are nothing to miss). Nonetheless, with tech driving the majority of the current rally—and expertise seemingly having nowhere to go however up—what’s to cease continued, speedy progress when the Fed’s tried-and-true strategies can’t appear to dampen investor enthusiasm? A more in-depth take a look at what befell this quarter might supply some clues.

1Q was all about imply reversion from the 2022 dynamics as rate of interest expectations violently declined. Cracks within the banking system, easing inflation, and indicators of some slowdown in US consumption have market members anticipating the top of the Fed’s hike cycle inside the 12 months. On the similar time, there was a marked reversal in inventory valuations, with most of the large losers of 2022 rising to develop into large winners in 1Q. And whereas progress shares recovered their market management place (pushed by mega-cap tech, unprofitable tech, and costly software program shares), small caps, healthcare, and defensive shares underperformed. Within the US, mega-cap tech shares returned a whopping +31%, with the remainder of the S&P returning simply +2%.

Diving deeper into the ROBO World Indexes, 1Q demonstrated the power and potential progress trajectory of firms in robotics, AI, and healthcare applied sciences:

ROBO

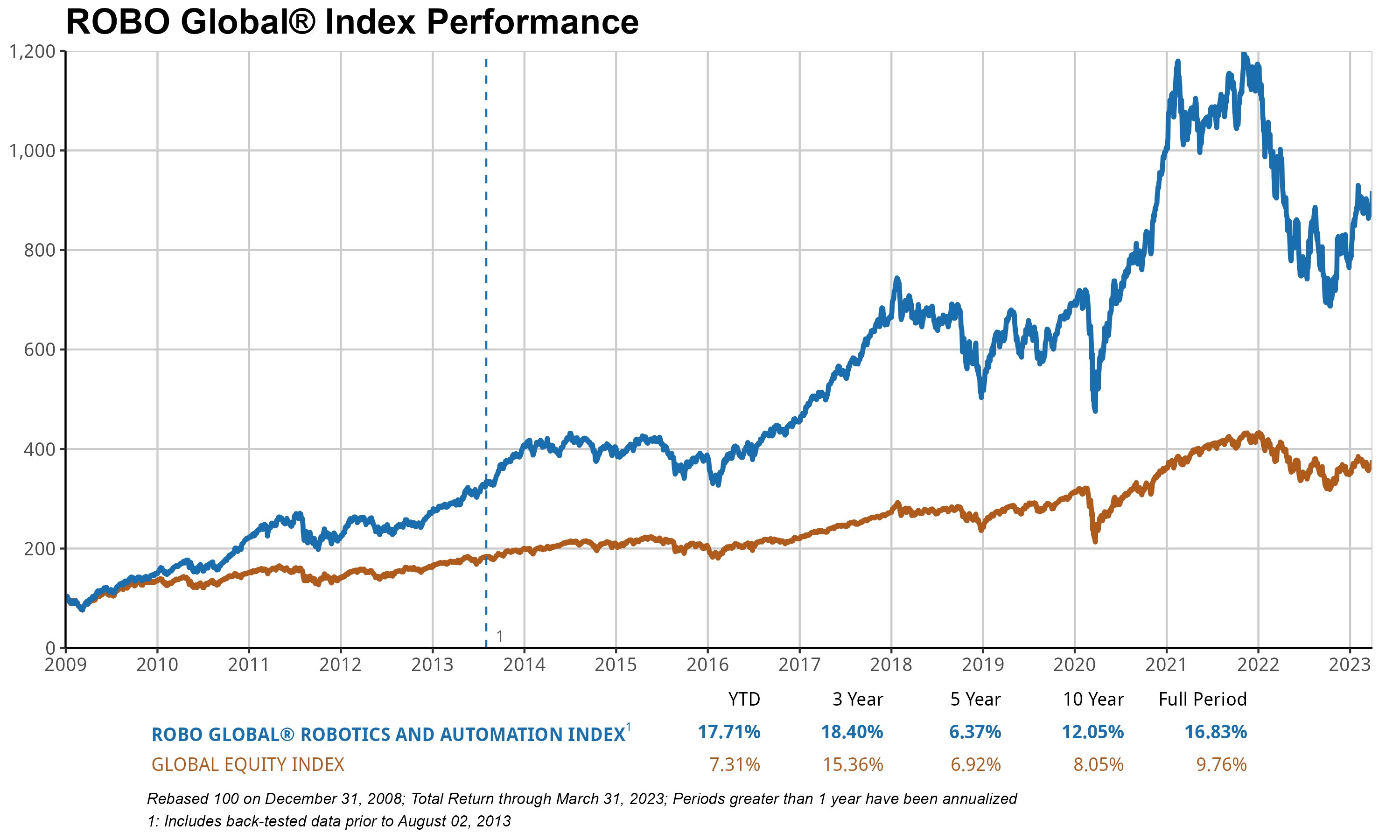

The ROBO World Robotics & Automation Index (ROBO) logged double-digit share features for the second consecutive quarter, returning +17.71% and handily outperforming the 7.3% achieve for the MSCI AC World Index (ACWI)1 by greater than 10ppt in the course of the quarter. The ROBO index of best-in-class robotics and automation equities all over the world was led by robust features in Computing & AI (+25%), Actuation (+22%), and Logistics Automation (+18%), whereas European (+12%) and Healthcare (+4%) shares lagged.

AI and semiconductor shares delivered the strongest efficiency in Q1, with iFlyTek (+95%), Nvidia (+90%), World Unichip (+71%), and Samsara (+59%) topping the charts. The appearance of generative AI fashions, the ChatGPT craze, and the increase in eye-opening functions have definitely led to renewed optimism across the group, with valuations reaching astonishing ranges as soon as once more. For instance, Nvidia is now buying and selling on 60x ahead PE2 and 25x gross sales, not too far off its 2021 excessive of 70x PE3.

The excellent news is that different areas of the portfolio stay comparatively low cost in comparison with the areas of the portfolio mentioned above, particularly cyclical shares in industrial end-markets similar to manufacturing and industrial automation (17x), meals and agriculture (16x), and Japanese shares (15x). We additionally observe that non-US shares, which account for 56% of the ROBO portfolio, are buying and selling at a considerable low cost (18x) in comparison with US shares (36x). That is very true in Japan. Japanese firms, which account for 22% of the ROBO index and have a mixed 40% share of the world’s industrial robotic market, are, in our opinion, poised to profit from each the sturdy financial restoration in China after a chaotic path out of Covid restrictions, and the dramatic depreciation within the Japanese Yen, which supplies a considerable price benefit and will result in margin enlargement.

In mixture, ROBO is buying and selling on a 26x ahead PE, in contrast with the 24x common since inception practically 10 years in the past and the 2021 excessive of 36x. In the meantime, earnings progress stays robust relative to broad fairness indices, with expectations for a ten% earnings per share4 (EPS) improve in 2023 (much like what we noticed in 2022), with 8% gross sales progress consistent with the long-term common. We consider this displays the power in demand for automation. Adoption has continued to speed up throughout more and more broad swaths of the financial system.

Regardless of the speedy improve in the price of capital, M&A exercise is strong within the Robotics & Automation area, with two index members, Stratasys and Nationwide Devices, receiving takeover bids for the reason that begin of 2023. This brings the overall variety of takeover makes an attempt on ROBO index members to 30 since 2013, with a median of about three per 12 months.

Along with the standard 1Q rebalance, March noticed three adjustments to the ROBO index: Symbotic was added, and Amano and Shenzhen Inovance had been excluded. We consider Symbotic has quickly emerged as a frontrunner in logistics and warehouse automation, due to its complete resolution for automating the processing of pallets and instances for retailers. In just some years, it has amassed an unlimited order backlog price over $12 billion for greater than 170 methods, primarily with Walmart5. Amano was excluded on decreased income and expertise management scores, and Shenzhen Inovance was eliminated on account of a rise in overseas possession. Shenzhen Inovance has returned a complete 279% since its inclusion within the ROBO index in 2019.

THNQ

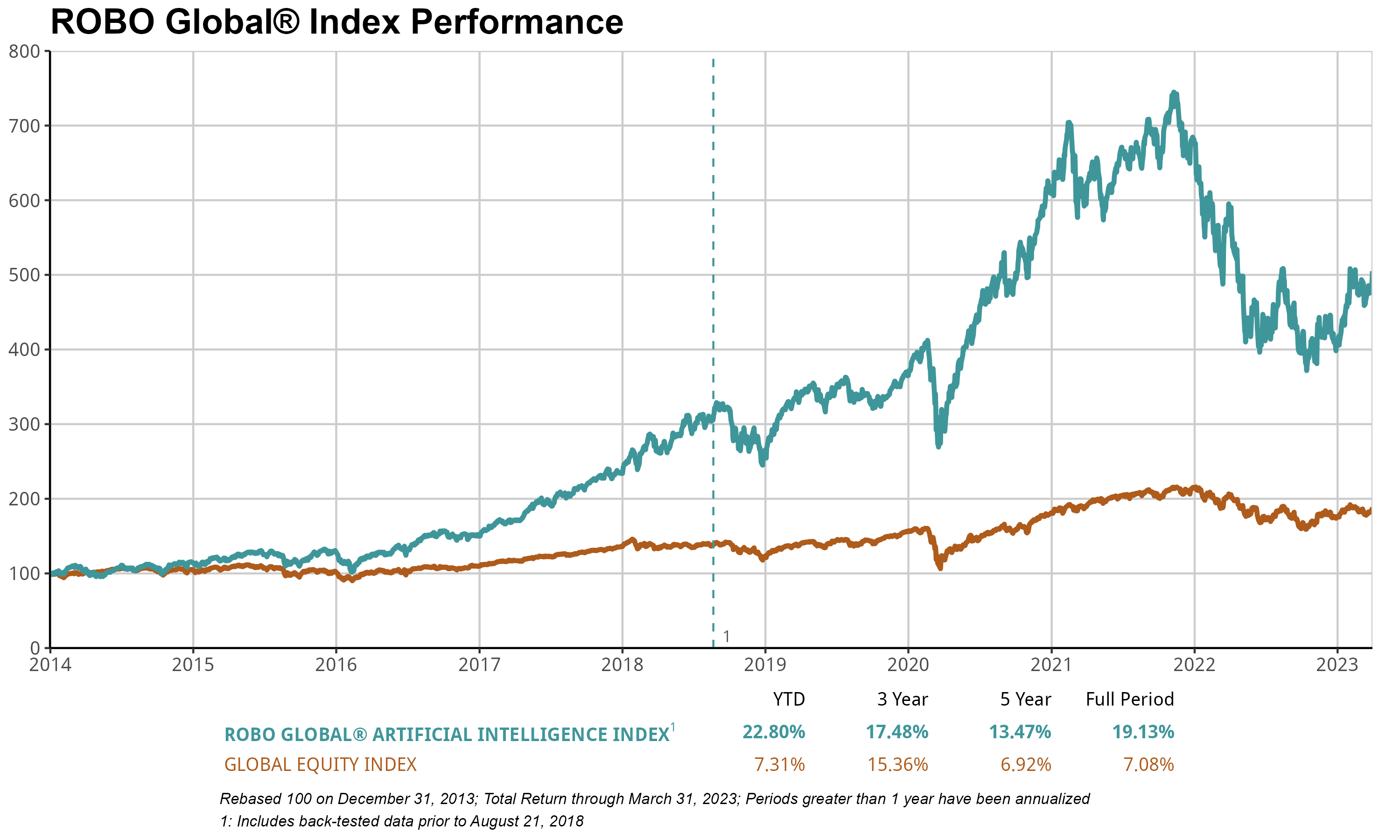

The ROBO World Synthetic Intelligence Index (THNQ) gained 22.8% in 1Q, far outperforming ACWI (+5%). The advances of ChatGPT have created large optimism available in the market, and we consider THNQ is a good way to seize the evolution of this ecosystem. AI, in fact, reaches far past “simply” knowledge analytics. As most of the most influential expertise visionaries on the earth have opined, AI is probably the most disruptive expertise innovation of our lifetime. Enterprises are embracing AI to make use of myriad kinds of knowledge to their benefit and to combine processes throughout all strains of enterprise and industries. The checklist of functions is as spectacular as it’s huge.

ChatGPT, a member of the generative pre-trained transformer (GPT) household of language fashions, has gained recognition in recent times for its capability to generate human-like textual content content material. It’s a sort of synthetic intelligence (AI) that makes use of machine studying algorithms to research giant quantities of textual content knowledge and generate responses in a conversational method. One cause for the ChatGPT craze is that it has the flexibility to carry pure and fascinating conversations with customers. It could possibly perceive and reply to a variety of subjects and may even generate personalised responses primarily based on consumer enter. This makes it a useful gizmo for duties similar to customer support, chatbots, and even creating content material for social media or web sites. One more reason for ChatGPT’s recognition is that it’s comparatively straightforward to make use of and requires minimal setup. Many software program builders and corporations have begun incorporating ChatGPT into their services and products, making it extra broadly accessible and accessible to most people.

In our opinion, Nvidia is seen because the clear chief in AI, a sector that’s predicted to develop dramatically—and shortly. Based on a current report[1], the worldwide AI market was valued at $119 billion in 2022 and is anticipated to increase to $1.59 trillion as quickly as 2030, leading to an estimated compound annual progress fee6 (CAGR) of 38% between 2022 and 2030. The drivers of that progress stretch throughout the huge panorama of AI functions, together with healthcare, finance, retail, automotive, and extra. In a world the place AI functions are a digital “goldmine,” as a number one AI chip supplier, NVDA is delivering the shovels required to dig for fortunes. NVDA’s AI merchandise embrace a full line of {hardware} and software program, starting from NVIDIA GPU Cloud (focusing on cloud functions) to NVIDIA Jetson (focusing on autonomous machines), to NVIDIA TensorRT (focusing on high-performance deep studying). The corporate posted over +90% progress in 1Q, serving to to push the THNQ index to its personal double-digit features for the quarter.

HTEC

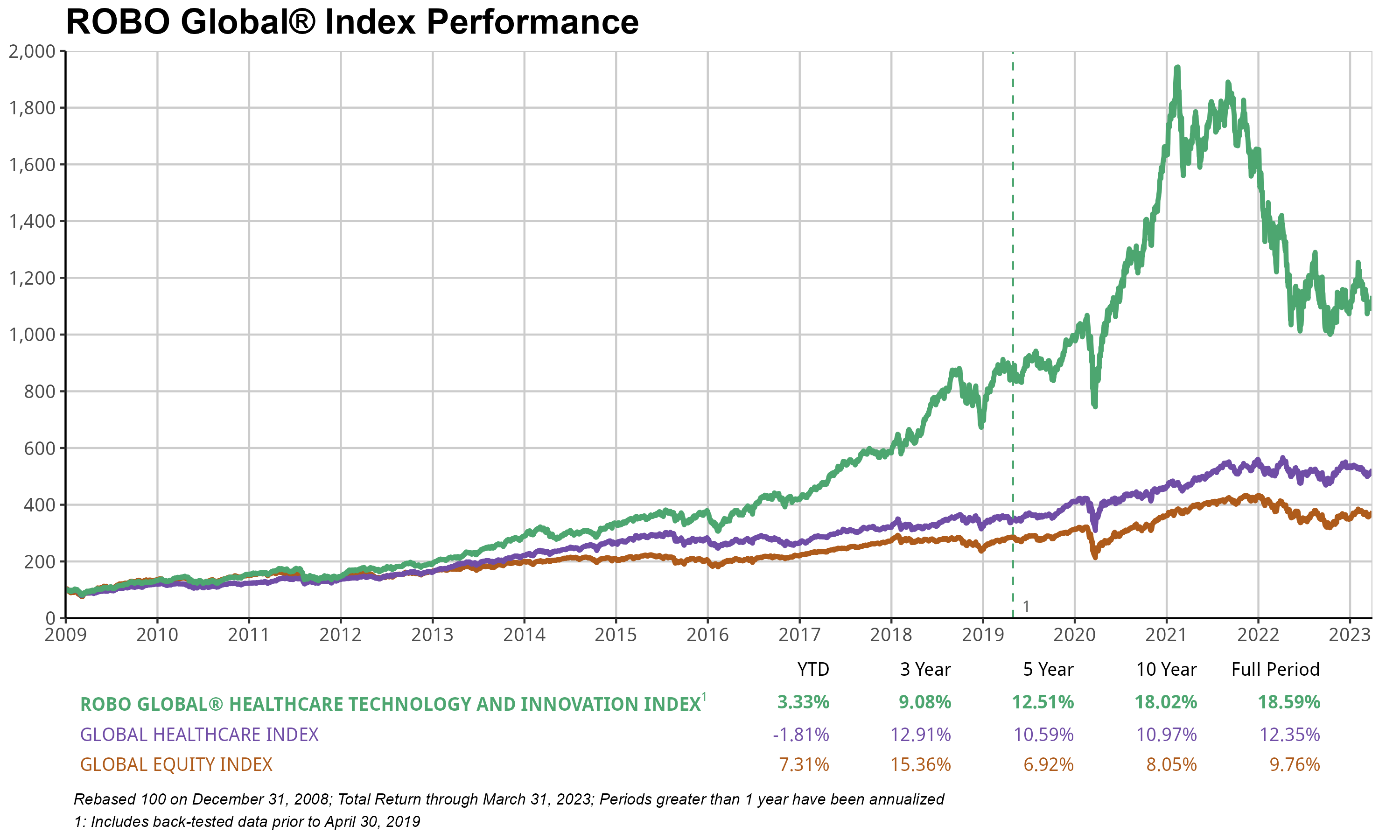

The ROBO World Healthcare Know-how & Innovation Index (HTEC) gained +3.18% in 1Q, barely underperforming ACWI’s +5% achieve. Constructive features had been pushed by Information Analytics (+12%), however this was offset by different sectors, together with Regenerative Medication (-17%) and Precision Medication (-13%). Importantly, we continued to see main innovation milestones in the course of the quarter, such because the collaboration between Vertex and CRISPR Therapeutics, which builds on their focus of making cell and genetic therapies for eradicating critical illnesses. A brand new licensing settlement between the 2 firms will possible speed up the event of Vertex’s hypo-immune cell therapies for the remedy of sort 1 diabetes. Cell and genetic therapies are key to their technique of creating transformative therapies for critical illnesses, and this settlement is a vital subsequent step in cementing their management in these modalities as they carry ahead their broad gene and cell-based therapeutics portfolio.

Moreover, Natera introduced extra optimistic information lower than 6 months after its VA protection settlement for minimal residual illness monitoring (MRD). A brand new molecular diagnostics providers program (MolDX) will now cowl the Signatera molecular MRD for sufferers with IIb or extra superior breast most cancers, together with the HR-positive, HER2, and triple-negative sorts, including to their current colorectal, bladder, and pan-cancer monitoring. The announcement instantly elevated the highest and backside line for 2023 and past, as the typical promoting value7 (ASP) is estimated to be $2.5K–$3.5K, and there are tens of hundreds of eligible sufferers yearly, which may see $30 million accretive this 12 months—a potential 3–5% enhance to the topline this 12 months alone relying on adoption pace. The end result: the inventory jumped 17% on the day of the announcement.

Simply because the dramatic climate patterns are anticipated to proceed throughout the US and across the globe, there isn’t a cause to anticipate calmer waters available in the market within the months and years to come back. The tendency for traders to react to crises of every kind is unlikely to waver. On the similar time, we consider it’s clear that expertise is including worth to just about all the pieces it touches, and when firms ship applied sciences that drive worth, traders might in the end reap rewards. No matter how the financial system, the Fed, or the “disaster of the second” impacts the markets within the quick time period, look ahead to expertise—together with robotics, automation, and healthcare applied sciences—to behave probably because the predictable buoy that lifts portfolios greater and better.

[1] Synthetic Intelligence (AI) Market Measurement, Progress, Report 2022-2030, Priority Analysis, January 2023

Sources & Definitions:

1 MSCI AC World Index is MSCI’s flagship world fairness index, and is designed to symbolize efficiency of the complete alternative set of large- and mid-cap shares throughout 23 developed and 24 rising markets.

2 The ahead P/E estimates the relative worth of the earnings.

3 The value-to-earnings (P/E) ratio relates an organization’s share value to its earnings per share.

4 Earnings per share (EPS) is an organization’s web revenue divided by the variety of widespread shares it has excellent.

5 Supply: Symbotic

6 The compound annual progress fee (CAGR) is the speed of return (RoR) that might be required for an funding to develop from its starting steadiness to its ending steadiness, assuming the earnings had been reinvested on the finish of every interval of the funding’s life span.

7 The time period “common promoting value” (ASP) refers back to the common value a very good or service is bought for.