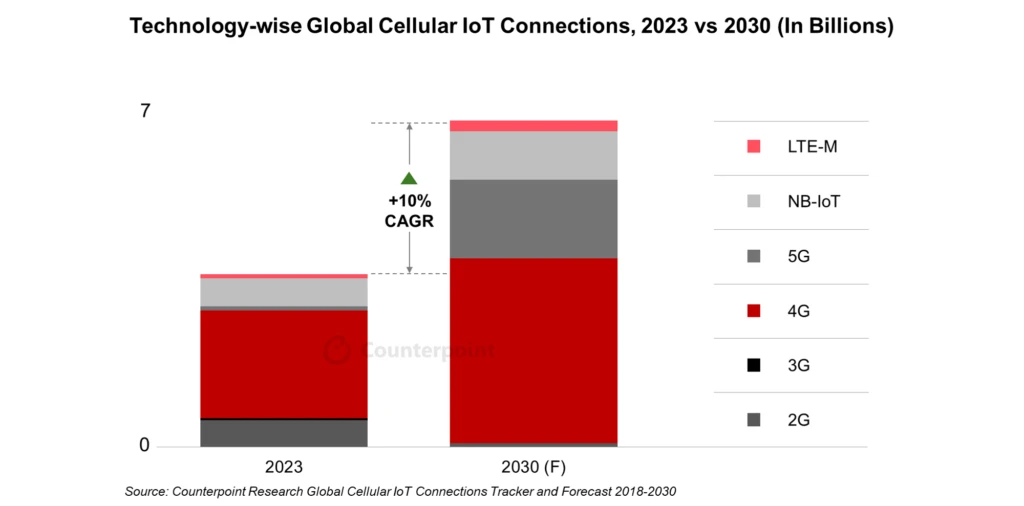

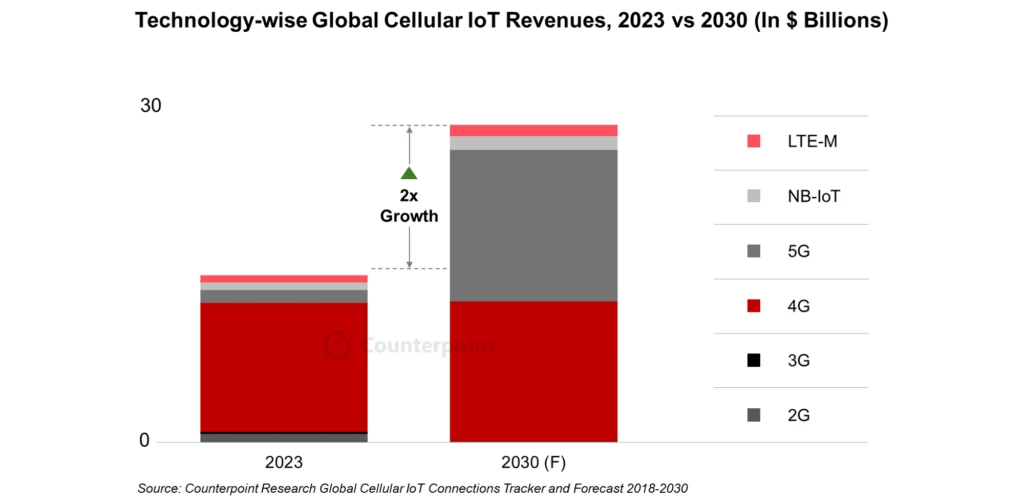

The variety of international mobile IoT connections jumped 24 p.c in 2023 to complete the yr at 3.3 billion; the quantity will improve by 88 p.c (at a compound development price of 10 p.c per yr) to succeed in 6.2 billion by 2030. So says Counterpoint Analysis, which has up to date its IoT Connections Tracker to additionally forecast that complete revenues from mobile IoT will surpass $26 billion by 2030 – which is up 90 p.c from $13.7 billion in 2023, which is up 17 p.c, in flip, on 2022.

The typical income per consumer (or ‘factor’; ARPU) on mobile IoT connections has continued to say no, however ought to stabilize within the “latter a part of the last decade”, stated the agency. On the finish of 2023, China retained the lion’s share (nearly 70 p.c) of the mobile IoT market with 2.3 billion connections; the determine, up 26 p.c on 2022’s depend, surpasses the variety of cell phone subscribers within the nation. On the identical time, China solely contributes about 36 p.c of world mobile IoT revenues.

Mohit Agrawal, analysis director at Counterpoint, commented: “China continues to roll out low-cost IoT plans for speedy deployment. A large portion of connections in China function on 2G and NB-IoT networks, with ARPUs decrease than $2.2 per yr. Trying forward, we count on ARPUs to stabilize, significantly with the appearance of 5G and development of 4G Cat-1 bis options as China will proceed to broaden its connections into the automotive, sensible meters, and sensible retail sectors.”

Counterpoint expects 5G to account for almost 50 p.c of mobile IoT revenues by 2030, catering to high-demand purposes together with autonomous automobiles, industrial automation, and immersive sensible cities, it stated. However related vehicles, utility meters, and retail tools, principally POS units, dominate, by way of IoT purposes; and they’ll account for greater than 60 p.c of the market by the “finish of 2030”.

“These sectors will drive the expansion of IoT, reworking industries with real-time connectivity and effectivity,” it wrote. It added: “The market is extremely consolidated, with the highest 10 operators dominating completely. This development is anticipated to proceed for some time. Nevertheless, operators from rising areas are gaining momentum. As digitization and community enlargement speed up, these areas are set to develop their IoT subscriber bases, pushed by rising demand for IoT options.”

Siddhant Cally, analysis analyst at Counterpoint, stated: “We’re witnessing a big improve in mobile IoT use instances equivalent to utilities and related automobiles. Many rising nations are implementing digital transformation plans that prioritize the deployment of public service options. The arrival of 5G will play a vital function in driving connectivity-based revenues, as operators capitalize on the potential of huge machine-type communications (mMTC), significantly as 2G and 3G applied sciences are phased out.”