Nigeria is residence to Africa’s greatest cell market by a ways, with 217.5 million subscriptions on the finish of 2023, up from 209.5 million a 12 months earlier.

The subsequent largest African markets at end-2023 had been South Africa with 118.9 million subscriptions, and Egypt with 111.1 million, based on TeleGeography’s GlobalComms Database.

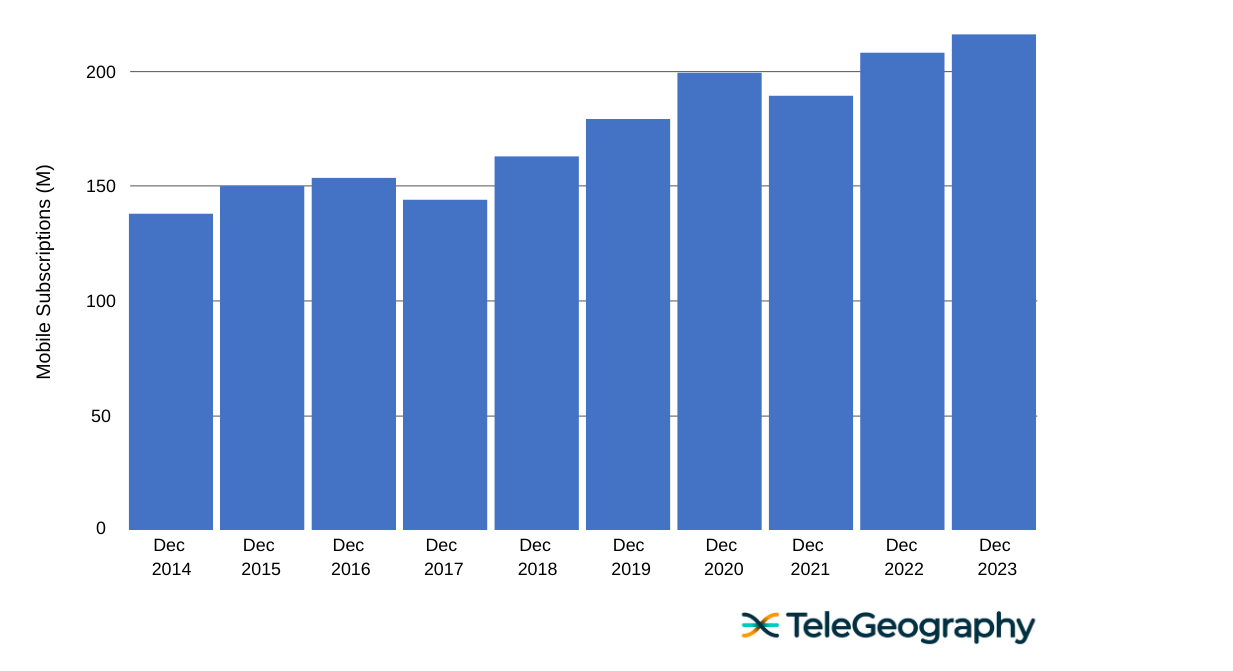

Following years of sturdy development, the Nigerian cell sector registered its first annual contraction in 2017. Nigeria’s variety of subscriptions dropped by 6.2% that 12 months, as a result of a SIM registration marketing campaign that resulted within the disconnection of hundreds of thousands of inactive or incorrectly registered accounts.

Progress resumed in This autumn 2017, averaging an annual charge of 11% for the next three years. By end-2020, Nigeria reached 200.7 million energetic SIMs.

Fast development got here to a halt in 2021, nevertheless, following the implementation of new rules to drive all cell phone customers to replace their registration with their Nationwide Identification Quantity (NIN). This transfer additionally noticed the sale and activation of recent SIMs for all operators briefly suspended from December 2020 till the next April.

As such, the market complete declined by 5% in 2021. In early April 2022, the NIN-SIM linkage train got here to an finish, permitting the annual development charge to rebound to 10%. The subscription complete rose a extra modest 4% in 2023.

Current Progress

Nigeria, Cell Subscriptions Progress 2014-2023

Though effectively forward of different African nations when it comes to subscription quantity, in relation to inhabitants penetration, Nigeria sits thirtieth out of 57 nations, with a determine of 96%.

Whereas that statistic could look affordable, there are nonetheless tens of hundreds of thousands of Nigerians with out connectivity. The penetration charge is boosted by the big numbers of customers who personal two or extra SIM playing cards in an effort to reap the benefits of on-network airtime offers.

The working surroundings poses quite a lot of important challenges, together with worsening financial situations, insufficient energy provide, gasoline shortages, a number of taxation, vandalism of community infrastructure, foreign money depreciation, and heightened instability in a number of areas.

Operators have complained that they’re struggling to deal with large power worth rises, with power now accounting for round 40% of working prices, based on some estimates.

MTN in First Place

South African-owned MTN leads the sector, controlling 36.6% of all Nigerian cell customers on the finish of 2023 with 79.7 million subscriptions.

MTN has maintained its primary place regardless of regulatory measures adopted by the Nigerian Communications Fee (NCC) to mitigate its important market energy, in addition to current strikes by the operator itself to disconnect hundreds of thousands of subscriptions with incomplete registration paperwork.

The latter resolution was prompted by the hefty fantastic MTN acquired in October 2015 for failing to fulfill a deadline to disconnect round 5.1 million unregistered SIMs. The preliminary NGN1 trillion ($5.2 billion) penalty was ultimately negotiated all the way down to NGN330 billion by mid-2016.

As a part of the settlement association for the fantastic, MTN Nigeria dedicated to itemizing a portion of its shares on the Nigeria Inventory Alternate. This ultimately came about in Might 2019 by way of a “itemizing by introduction,” adopted by a public provide on the finish of 2021, which noticed MTN Group’s shareholding in its Nigerian unit lowered from 78.8% to 75.6%.

The cellco’s efficiency lately has additionally been severely impacted by the suspension of regulatory providers by the NCC, which restricted the introduction of any new tariff plans and promotions till March 2016. Extra contributing elements embrace financial situations and the restricted availability of U.S. {dollars}.

Three Predominant Rivals

MTN shouldn’t be the one Nigerian operator going through important challenges to its enterprise.

MTN shouldn’t be the one Nigerian operator going through important challenges to its enterprise.

9mobile—the nation’s fourth largest cellco by subscriptions—was compelled right into a rebranding in July 2017 and the following sale of its operations.

After defaulting on a $1.2 billion mortgage as a result of an financial downturn, foreign money devaluation, and greenback shortages, talks with banks didn’t convey a decision. UAE-based buyers Mubadala Improvement Firm and Etisalat Group (now e&) then pulled out, forcing Etisalat Nigeria to rebrand to 9mobile.

The Teleology Nigeria consortium emerged as the popular bidder for 9mobile in February 2018 with a proposal of $301 million, beating the one different participant, Smile Telecoms. Nevertheless, by early 2019, shareholder disagreements noticed some buyers stroll away.

All of this had a notable influence on 9mobile’s subscription base, leaving it effectively behind its three bigger rivals with a market share of simply 6.4% at end-2023.

MTN Out Entrance

Nigerian Cell Market, December 2023

.png?width=1280&height=729&name=Nigerian%20Mobile%20Market%2c%20December%202023%20(1).png)

The second and third-placed gamers are nearly neck-and-neck in subscription phrases.

Indian-owned operator Airtel Nigeria claimed 61.8 million subscriptions and 28.4% of the market as of December 2023. Initially launched beneath the identify Econet Wi-fi Nigeria in December 2000, the cellco subsequently got here beneath the management Kuwait’s Zain Group.

In March 2010, Bharti Airtel of India agreed to amass nearly all of Zain Group’s African property in a $9 billion deal that included Zain Nigeria. The takeover concluded in June 2010 and Zain Nigeria was rebranded beneath the Airtel moniker by the tip of that 12 months.

Shut rival Globacom, which trades beneath the Glo identify, is majority owned by Nigerian petrochemical agency Conpetro. Globacom was awarded Nigeria’s second nationwide operator license in August 2002 and acquired the nation’s fourth nationwide GSM concession as a part of the bundle.

Glo may declare 28.3% of the full market at end-2023, with 61.6 million subscriptions.

Rounding out the sector are a handful of small 4G and 5G operators with negligible market shares. They embrace Smile Communications, which was based in 2008 by pan-African operator Smile Telecoms Holdings and awarded a license in July 2009. It took Smile till February 2013 to launch its FDD-LTE community.

Ongoing Issues

Nigeria’s cell operators continuously face complaints from each the NCC and customers over poor high quality of service and community congestion, however in flip have claimed that vandalism of infrastructure, a number of taxation, and insufficient energy provide hamper their efforts to function successfully.

Moreover, heightened instability and unrest in a number of components of the nation have restricted the power to hold out routine upkeep and emergency repairs.

Moreover, heightened instability and unrest in a number of components of the nation have restricted the power to hold out routine upkeep and emergency repairs.

Airtel’s infrastructure was badly affected by insurgents within the northeast in early 2020, and MTN’s community was restricted within the northern states on the finish of 2021 to handle safety points.

Within the absence of a dependable electrical energy grid, base stations have to be served by mills and powered by diesel. As well as, telecom firms proceed to face a number of taxation at native, state, and federal degree, with service disruptions associated to tax claims mentioned to value the business hundreds of thousands of {dollars} yearly.

The Affiliation of Licensed Telecommunications Operators of Nigeria warns that native authorities companies continuously threaten to close down base stations in quite a lot of states if firms fail to pay quite a few taxes and levies. MTN, for one, says it has suffered arbitrary enforcement actions and repair disruptions by events engaged on behalf of tax-raising our bodies.

All of those points definitely make the Nigerian cell market one to look at.