At this yr’s Pacific Telecommunications Council convention, I spent a while speaking by TeleGeography’s newest pricing analysis findings and tackling the most typical questions we have obtained over the previous yr.

In case you missed it, here is a recap of my Taylor Swift-themed presentation: World Pricing Tendencies in a New Period.

Final yr, we discovered ourselves in uncharted territory. Delays in new provide had dramatically slowed value erosion around the globe, leaving us to surprise if costs had been truly rising.

Are we out of the woods but? Not fully.

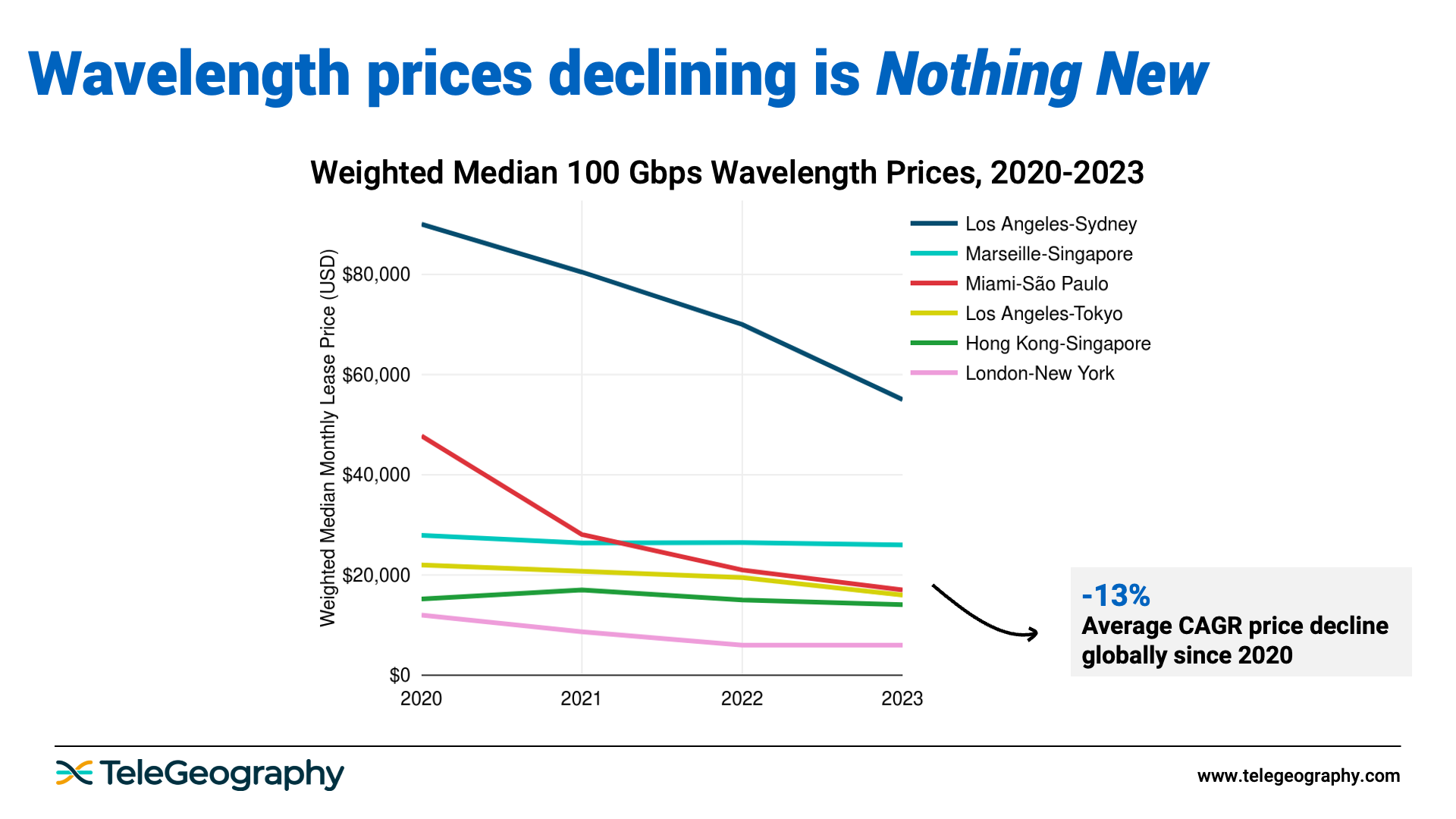

Over the previous three years, 100 Gbps costs throughout six key international routes continued to lower about 13% on common.

After all, we noticed a variety in value erosion traits—costs decreased simply 2% on Marseille-Singapore vs. 29% on Miami-São Paulo—however that is not the large story right here.

Regardless of these declines, value erosion is going on at a a lot slower tempo than we’re used to seeing available in the market.

Within the determine under, we have mapped out 100 Gbps wavelength CAGR value declines from 2017-2020 (turquoise) and 2020-2023 (darkish blue).

As you possibly can see, value declines have dramatically slowed throughout all six of those routes. From 2017-2020, we noticed a 30% common decline. That quantity decreased to simply 13% from 2020-2023.

There are a number of elements at play right here.

These are very aggressive submarine cable routes, and 100 Gbps costs are already low. Plus, we’re nonetheless seeing delays in new community provide on a whole lot of these routes.

Sure, card shortages and provide chain disruptions have resolved themselves, however geopolitical points—akin to within the Crimson Sea and South China Sea—are delaying community tasks.

Fewer cables with stock at one time has led to much less aggressive value strain. Nonetheless, on routes with current upgrades, new provide, and pre-sales on new programs, value erosion is returning to increased ranges.

On routes with current upgrades, new provide, and pre-sales on new programs, value erosion is returning to increased ranges.

Within the meantime, uncertainty on the timeline of future provide on some routes has modified buyer buying patterns.

Provide is being snatched up earlier than it turns into obtainable or purchased in bulk, so even when upgrades are occurring, that capability might already be spoken for. Prospects are taking capability on the value that’s provided, and that is serving to to keep up value factors.

What about 400 Gbps? How is demand for this service shaping up, and what are pricing fashions trying like worldwide?

How have these transport traits impacted the transit market?

Final yr, our information recommended that the availability shortage and inflationary strain on community tools prices had additionally muted IP transit value erosion. That is now not the case.

To study extra, obtain my full slide deck.

Along with what we have already coated right here, these slides present the influence of transport on transit pricing and the place we’re headed in our subsequent period.