5 years after Apple Card was first launched in 2019, 12 million Apple Card customers are reaping the advantages of Apple Card’s award-winning expertise. From easy-to-navigate spending instruments, to Apple Card Household, and the just lately added Financial savings account,1 Apple Card continues to reinvent the bank card expertise and supply options designed to assist customers lead more healthy monetary lives.

“We designed Apple Card with customers’ monetary well being in thoughts, and it’s rewarding to see our greater than 12 million clients utilizing its options to make more healthy monetary selections,” mentioned Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets. “We’re pleased with what we’ve been capable of ship to Apple Card clients in simply 5 years. As we have a look at the 12 months forward and past, we’re excited to proceed to innovate and spend money on Apple Card’s award-winning expertise, and supply customers with extra instruments and options that assist them lead more healthy monetary lives.”

“Because the launch of Apple Card, the client response has been glorious, and we’re happy that we proceed to see customers incorporate the revolutionary instruments and options into their monetary lives,” mentioned Invoice Johnson, Goldman Sachs’s CEO of Enterprise Partnerships in Platform Options. “We’re dedicated to persevering with to ship a wonderful expertise for Apple Card clients.”

Utilizing Apple Card’s digital-first instruments and advantages, customers are:

- Maximizing their Each day Money rewards: Final 12 months, customers earned over $1 billion in Each day Money from spending on Apple Card.

- Saving for the longer term and rising their rewards with Financial savings: The Financial savings account shortly grew to become a favourite characteristic amongst Apple Card customers and reached over $10 billion in deposits in just some quick months. Right this moment, the overwhelming majority of customers auto-deposit their Each day Money into Financial savings, and practically two-thirds of customers have deposited further funds from a linked checking account to additional assist them save for the longer term.2 Right this moment, Financial savings presents a high-yield APY of 4.50 p.c.3

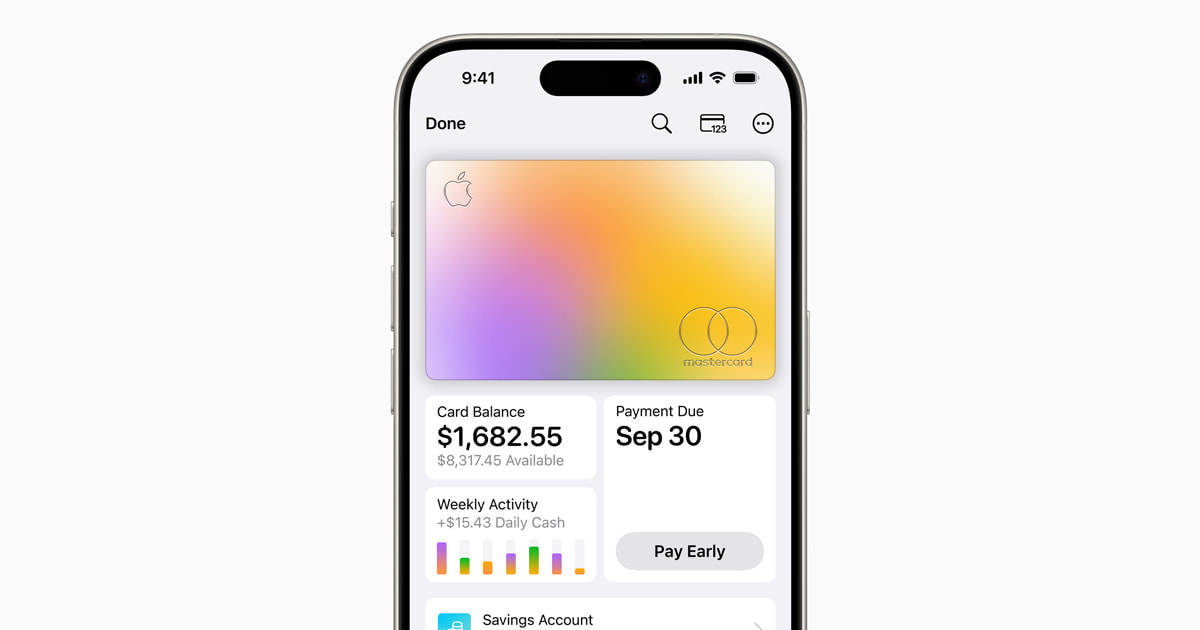

- Making wholesome monetary selections with Apple Card’s cost instruments: Practically 30 p.c of Apple Card clients make two or extra funds monthly. Apple Card makes it simpler for customers to grasp and pay their invoice, as funds are at all times due on the final day of the month, and with the assistance of the curiosity estimator instrument, customers can simply view the steadiness on their card and use the instrument to estimate the potential curiosity in actual time to allow them to make an knowledgeable choice earlier than they make a cost.

- Utilizing Apple Card Household to increase wholesome funds to the Household Sharing Group: Since its introduction in 2021, greater than 1 million Apple Card customers share Apple Card with their Household Sharing Group by Apple Card Household, and practically 600,000 customers are constructing credit score equally with their spouses, companions, or one other trusted grownup on Apple Card.4

- Using Path to Apple Card to increase their entry to credit score: Since its introduction, over 200,000 customers and counting have been authorized for an Apple Card after enrolling within the Path to Apple Card program and efficiently following this system’s customized steps, that are designed to enhance a person’s monetary well being.

- Having fun with the privateness and safety of Apple Card: Constructed with the privateness and safety of iPhone, and distinctive options comparable to Superior Fraud Safety, Apple Card presents real-time fraud safety, and in 2024 was acknowledged because the Finest Credit score Card for Privateness by Bankrate.

Constructed into Pockets on iPhone, Apple Card has reworked the bank card expertise by providing easy-to-use digital instruments, creating much more methods customers can get essentially the most out of their rewards, and serving to clients construct and lengthen wholesome monetary habits — all whereas providing the privateness and safety customers anticipate from Apple.

Apple Card was additionally named the Finest Co-Branded Credit score Card for Buyer Satisfaction with No Annual Payment within the J.D. Energy 2023 U.S. Credit score Card Satisfaction Research, marking the third consecutive 12 months Apple Card and issuer Goldman Sachs have been acknowledged by J.D. Energy with a No. 1 rating of their phase within the U.S. Credit score Card Satisfaction Research.5