October greetings from Boston, Cedar Rapids, and Kansas Metropolis. It was nice to fulfill with Troy Doom, the CEO of Ice Home America, one among Fort Level Capital’s investments (extra on the corporate right here) in Boston earlier this month. Third quarter earnings begin subsequent week and proceed into November, offering traders with 2024 and 2025 priorities for the telecom and infrastructure sectors. After a brief market commentary, we are going to focus this week’s Transient on questions we’d ask Comcast and Constitution. Whie their legacies are rooted in linear video, their futures are extremely depending on wi-fi providers and broadband.

Right here is the ultimate earnings presentation schedule with hyperlinks to every of the investor relaitons web sites. You probably have not had an opportunity to learn the final Transient (right here), we recommend you accomplish that previous to Tuesday when Verizon kicks off the earnings parade.

The fortnight that was

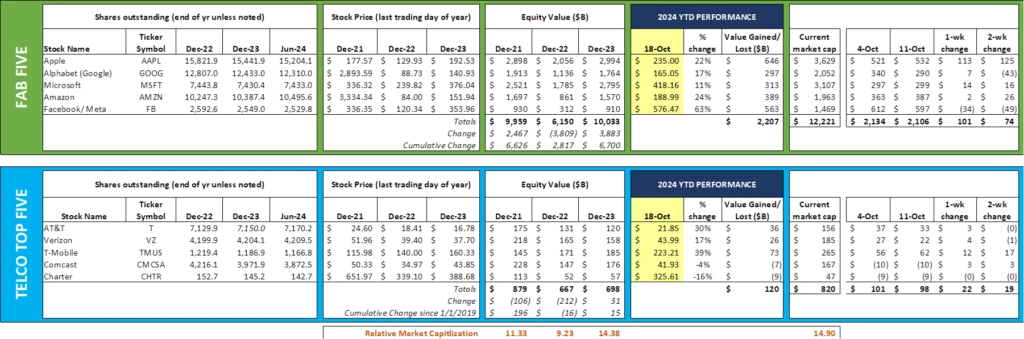

Whereas the Fab 5 and the Telco Prime 5 have been each up within the mixture during the last two weeks, all or practically all of these good points have been pushed by two shares: Apple (+$125 billion) and T-Cellular (+$17 billion). Of the ten shares we monitor, T-Cellular and AT&T are at present the second and third-highest share gainers for 2024, outpacing Google, Apple, Amazon and Microsoft. Sure, a greenback invested in AT&T on January 1 has returned extra worth than in every of the Fab 5 shares besides Meta/ Fb. We’d not be shocked to see Ma Bell overtake Comcast someday within the subsequent 6-9 months because the third most precious US telecom. AT&T is a outstanding story that seems to have legs.

The Chinese language hack that impacted many carriers together with Verizon, AT&T, and Lumen is constant to draw lawmaker curiosity. Based on this Broadband Breakfast article, Congressional Democrats and Republicans on the Vitality and Commerce Committee despatched the heads of Verizon, AT&T and Lumen a sequence of questions with responses due by final Friday. The magnitude of this breach, based mostly on our conversations with analysts, was higher than others as a result of it might have enabled the Chinese language to find out how the federal government displays communications actions. For background, the unique Wall Road Journal article on the breach is right here and the follow-up article from The Washington Submit is right here.

Lastly, whereas we predict that Verizon is overpaying for Frontier’s property, there are lots of Frontier shareholders who take the alternative view. Based on this Reuters article, Glendon Capital Administration, who owns practically 10% of Frontier shares, has publicly introduced that they are going to be voting towards the deal. Cerberus Capital Administration, who owns greater than 7% of Frontier shares, has voiced considerations however has not gone so far as indicating a “no” vote.

3Q earnings questions (Half 2)

Within the first a part of our earnings questions (hyperlink above), we centered on Verizon’s pay as you go enterprise transformation, their Frontier acquisition rationale, T-Cellular’s postpaid churn problem, and AT&T’s enterprise wireline woes. General, wi-fi is challenged by the worth proposition of present and future know-how improvements. In brief, 5G has not created the step operate in worth creation for traders that different funding alternatives (e.g., Synthetic Intelligence) have. We’re getting into the sixth yr since deployment, and the customer-facing advantages are nonetheless rising.

We warned in regards to the 5G hype in July 2019, devoting a whole Transient to the subject: “About This Factor Known as 5G.” We posited that the way forward for 5G is dependent upon “Extra software program, doing extra issues, quicker and higher.” Like LTE, 5G relied on progressive purposes that will enhance lives. There’s nonetheless time, however outdoors of mounted wi-fi as a wired various for each residences and companies, it’s onerous to level to mass market purposes which have been remodeled due to 5G. Shipyards is perhaps extra environment friendly, however your yard hasn’t modified a bit.

This improvements drought has positioned extra stress on wi-fi carriers like Verizon and T-Cellular to develop subscriber share (5G has helped enhance community scalability and buyer profitability). That worth creation has come by two sources: a) Improved month-to-month revenues per wi-fi subscriber (ARPU) by adjustments in month-to-month subscription pricing buildings, and b) Mounted wi-fi providers to make the most of extra capability that ought to have been consumed by the software program improvements described earlier.

That brings us to Comcast and Constitution, two of the Telco Prime 5 which have had higher years. Because the finish of 2019, Comcast and Constitution’s fairness values have decreased by 27% and 58% %. The Triple Play tiger (Excessive Pace Web + Linear Cable + Dwelling Cellphone) of the earlier twenty years is now toothless because of Google (YouTube TV), Hulu (Comcast+Disney), Netflix, and wi-fi substitution. The identical technique used to cut back scale and profitability with incumbent telcos (create “Swiss cheese networks”) in earlier years is now being utilized by mounted wi-fi and fiber to the house (FTTH) suppliers to restrict cable’s scale economies. And the Reasonably priced Connectivity Program (ACP) is gone.

Regardless of all of those headwinds, cable marches on. They nonetheless have scale. They’ve alternatives to increase into beforehand unserved geographical areas. They proceed to develop their industrial enterprise. They’ve wi-fi. In brief, they’ve choices and proceed to have the next market share than fiber or mounted wi-fi of their footprint.

Listed here are the questions we’d pose to Constitution and Comcast:

- (For each). What number of gross additions are coming from fiber suppliers? These probably characterize prospects who’ve beforehand been double or triple play (wi-fi, not house cellphone) prospects and are returning to cable. Whereas there isn’t any bodily porting, this may be proxy for product superiority (a “port ratio” equal utilized in wi-fi).

Our view is that this quantity could be very low. Cable is dropping to fiber and prospects are reluctant to return for a lot of causes. First, new networks have fewer oversubscription points (cable nodes can turn out to be congested – suppose again to April and Might 2020 throughout COVID). Second, there may be an “funding” in fiber for many new prospects – the multi-hour set up course of. Lastly, most FTTH deployments include new Wi-Fi gear (many occasions built-in into the FTTH in-home tools) that’s Wi-Fi 6 or increased. Fiber can ship a buyer expertise that’s materially totally different from DOCSIS 3.1. That’s why the “port in from fiber” ratio is necessary.

We agree with the cable suppliers that mounted wi-fi is perhaps extra susceptible. However neither T-Cellular nor Verizon invested in 5G for the needs of solely offering mounted wi-fi. When a number of money flows are feeding the economics of a tower/ city/ area, the impression on wi-fi suppliers might be transferred to different services.

- (For each). Whither Xumo? We listened to a number of current investor convention updates from Constitution and Comcast and their set-top field/ aggregation three way partnership known as Xumo was barely talked about. Xumo streaming bins began distribution in October 2023, so a 12-month overview/ milestone announcement ought to have been made. Thus far, no information.

That is shocking because the Xumo platform is great (now we have been utilizing ours for six+ months and enormously choose it to Roku). Comcast contains one Xumo field for each new Xfinity Web buyer, and Constitution permits prospects to buy the field outright for $60. Each provide the “tools as a service” for $5/ mo. which represents a $6-8/ mo. low cost to set-top field prices.

Xumo additionally has a line of televisions which can be distributed by Greatest Purchase (right here) and Walmart (right here). A follow-up query like “Why not give away a Xumo TV with chosen bundles?” makes lots of sense if the next high quality expertise would create extra affinity (pun supposed) for conventional cable packages. With cloud DVR accessible/ included, the expertise could be extra cellular pleasant than a set-top field. We wrestle to see why each Constitution and Comcast aren’t pushing Xumo more durable and selling the 2025 roadmap.

- (For each). Will cable buy further spectrum? Chris Winfrey appeared to trace on the Goldman Sachs Communacopia convention in September that future shared spectrum purchases and deployments is perhaps within the offing:

“We’ve additionally bought CBRS licenses for shared license. We predict that framework could be very pro-consumer, and it’s good for lots of different contributors within the spectrum house. And so, we anticipate to proceed to be energetic within the shared-license spectrum house as nicely… In some sense, we’ve not been in a race [to deploy spectrum] due to the connection and the setup that now we have with Verizon and a few of that construct out is tempered by the connection with Verizon. We even have a big quantity of different capital initiatives and work and labor that should happen. However we are going to totally deploy the CBRS, however we’re not in a rush to do it. Apparently, the extra strains now we have, the higher the return on funding for the construct. So the return of deploying that spectrum and deploying these small cells simply continues to get higher.”

We agree with Chris that specializing in the shared spectrum house makes lots of sense for cable and suppose that they need to have a dialog with Dish about utilizing their CBRS holdings to extend capability.

- (For Comcast). When will Comcast totally mirror [Charter] Spectrum’s cellular pricing technique and product choices? Our guess is that Constitution’s introduction of aggressive buyouts (extra right here) and their “Anytime Improve” inclusion within the Limitless Plus Plan (right here) is popping some heads and driving extra gross provides than their Philadelphia-based cousin. Mike Cavanagh, Comcast’s President, made a remark that there was no “satisfaction of authorship” with respect to Constitution’s actions.

As a reminder, Constitution had 1.6 million (22%) extra wi-fi subscribers than Comcast on the finish of the second quarter. Over the past 4 quarters, Constitution has grown 80% quicker than Comcast (2.18 million web additions vs. 1.22 million). For 3Q, we’d not be shocked to see 200-300K extra web additions for Constitution than their counterpart. The first motive for this distinction is Spectrum’s deal with simplicity and switching promotions.

Whereas not wi-fi, we’d additionally counsel that Comcast mirror Constitution’s just lately introduced inclusion of Peacock Premium with all Spectrum TV prospects (announcement right here). It’s perplexing that Comcast has not prolonged their very own streaming service completely to their cable subscribers (see Peacock Premium promotions right here – simplification required).

- (For Constitution). How can shareholder worth be improved by further acquisitions? Chris Winfrey clearly articulated their capital allocation technique on the Goldman Sachs convention:

“… our capital allocation precedence, since I joined the corporate in 2010, really hasn’t modified, which is first port of name is to have natural investments that produce good and higher money flows over time and protect your terminal worth. Second is, to the extent there’s M&A that’s extra engaging than shopping for again your inventory, you do M&A. Third, you purchase again your inventory. And fourth, if you happen to actually have nowhere to go and also you wish to simply flip money again over to traders so it may be taxed, you do dividends. And that’s by no means actually been in our profile.”

We see a depressed Cablevision (a part of Altice) asset as Constitution’s subsequent transfer. Each shares are down 20+% over the previous yr (and Altice has misplaced 92% of its market capitalization during the last 5 years). Altice is suffering from issues with their mum or dad firm and monetary woes – the time seems proper for a transaction.

There is perhaps a deal the place Mediacom, one other rural-focused cable supplier (now in wonderful monetary situation), takes all the non-Northeast holdings (or frankly no matter Constitution doesn’t need). A transaction with further re-clustering of property between Constitution and Mediacom can also be attainable (they did this with Comcast when buying Adelphia Communications). Backside line: Whereas many acquisition alternatives exist or will floor within the subsequent yr, merging Lengthy Island and components of New Jersey into the remainder of the New York Metropolis metropolitan space would create worth for Constitution shareholders. Profitable execution of synergy achievement is excessive given the current expertise with Time Warner Cable and Brighthouse.

Now we have lengthy argued on this column that re-clustering of property (telco, cable, wi-fi) creates synergies and aggressive “moats.” Constitution might have the chance to have an effect on a transaction and will have a look at half/ all of Altice prior to purchasing again further shares.

Constitution and Comcast proceed to keep up their broadband share, however the different three corporations within the Telco Prime 5 aren’t idle of their fiber methods. It’s time to take some calculated dangers which can be centered on creating aggressive benefit. Comcast has extra items to work with and, after a really profitable Olympics, ought to rethink their playbook. Constitution is definitely enjoying their (weaker) hand very nicely, and can probably shock on many fronts, regardless of AT&T’s continued FTTH deployment success.

That’s it for this week. Search for the fourth week of Apple iPhone 16 Professional and Professional Max availability charts tonight on the web site, and within the subsequent Transient, we are going to start to digest every earnings report. Till then, when you have pals who want to be on the e-mail distribution, please have them ship an e mail to [email protected] and we are going to embrace them on the record (or they’ll join instantly by the web site).

Lastly – go Sporting KC, Davidson School Soccer, and Kansas Metropolis Chiefs!

Essential disclosure: The opinions expressed in The Sunday Transient are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t replicate these of CellSite Options, LLC, or Fort Level Capital.